Demand-Side Policies uses expansionary fiscal policy, using government spending and taxation to increase aggregate demand within an economy.

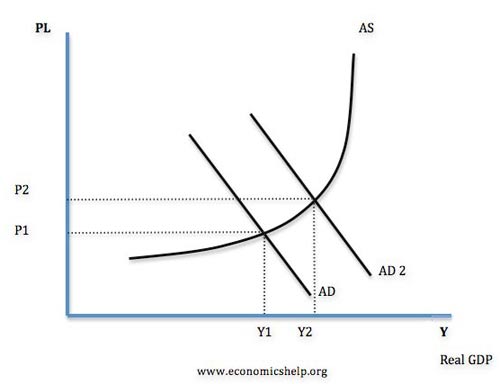

A cut to income tax will mean that people who are in work will have an increased disposable income, assuming that because people have more disposable income they will spend a greater quantity of money there is an increase in aggregate demand as consumption is a component. At the same time government revenue has decreased and so the budget deficit grows, leading to an increase in the component G in aggregate demand, causing an injection in the circular flow of income and this is shown by a rightward shift of AD to AD2.

Supply-Side Policies fiscal policy aims to increase an economy's ability to produce goods, through creating incentives to work, save and invest and to be entrepreneurial.

Many people also believe that a cut in income tax provides a short term increase in demand, helping to improve incentives to work longer hours or a get a new job as the more money they earn the more they get to keep. It may also help to reduce levels of unemployment as individuals will be better off working than staying outside the labour force. As there is an increased workforce aggregate supply will increase as more of one of the factors of production has increased, causing an increase in the economy's ability to produce goods, resulting in the rightward shift of AS to AS2.

No comments:

Post a Comment