A progressive Tax is one where the proportion of income paid in tax rises as income rises.Progressivity is based on the notion of ability to pay – that people on higher gross incomes are

better able to make a bigger contribution to the financing of collective public and merit goods and

the welfare state.

Income tax payable: by annual income,

2007/08

United Kingdom

Number of Total tax

liability Average rate of tax Average

taxpayers (thousands) after tax reductions (percentages) amount of

(£ million) tax (£)

£5,225–£7,499 2,460 263 1.7 107

£7,500–£9,999 3,630 1,330 4.2 365

£10,000–£14,999 6,380 7,000 8.8 1,100

£15,000–£19,999 4,890 10,500 12.4 2,150

£20,000–£29,999 6,670 24,400 14.9 3,660

£30,000–£49,999 5,220 33,700 17.1 6,460

£50,000–£99,999 1,750 28,200 24.5 16,200

£100,000–£199,999 418 17,200 30.8 41,200

£200,000–£499,999 123 12,000 34.0 98,200

£500,000–£999,999 22 5,230 35.6 241,000

£1,000,000 and over 8 6,370 35.8 782,000

A regressive tax is a tax unrelated to income that bears hardest on those least able to pay.

The result is that the average rate of tax is greatest for those on lower incomes.

Friday, 13 March 2015

The Effects of Income Tax Cuts in Demand-Side and Supply-Side Fiscal Policy

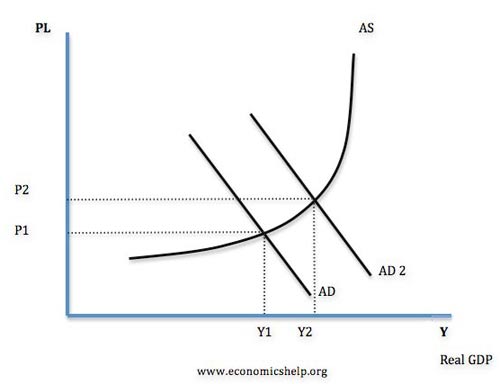

Demand-Side Policies uses expansionary fiscal policy, using government spending and taxation to increase aggregate demand within an economy.

A cut to income tax will mean that people who are in work will have an increased disposable income, assuming that because people have more disposable income they will spend a greater quantity of money there is an increase in aggregate demand as consumption is a component. At the same time government revenue has decreased and so the budget deficit grows, leading to an increase in the component G in aggregate demand, causing an injection in the circular flow of income and this is shown by a rightward shift of AD to AD2.

Supply-Side Policies fiscal policy aims to increase an economy's ability to produce goods, through creating incentives to work, save and invest and to be entrepreneurial.

Many people also believe that a cut in income tax provides a short term increase in demand, helping to improve incentives to work longer hours or a get a new job as the more money they earn the more they get to keep. It may also help to reduce levels of unemployment as individuals will be better off working than staying outside the labour force. As there is an increased workforce aggregate supply will increase as more of one of the factors of production has increased, causing an increase in the economy's ability to produce goods, resulting in the rightward shift of AS to AS2.

Distinguish Between the Government Spending Multiplier and the Tax Multiplier

The government spending multiplier is the relationship between the change in government spending and the resulting change in national income.

But the tax multiplier is the relationship between a change in taxation and the resulting change in national income.

But the tax multiplier is the relationship between a change in taxation and the resulting change in national income.

Tuesday, 10 March 2015

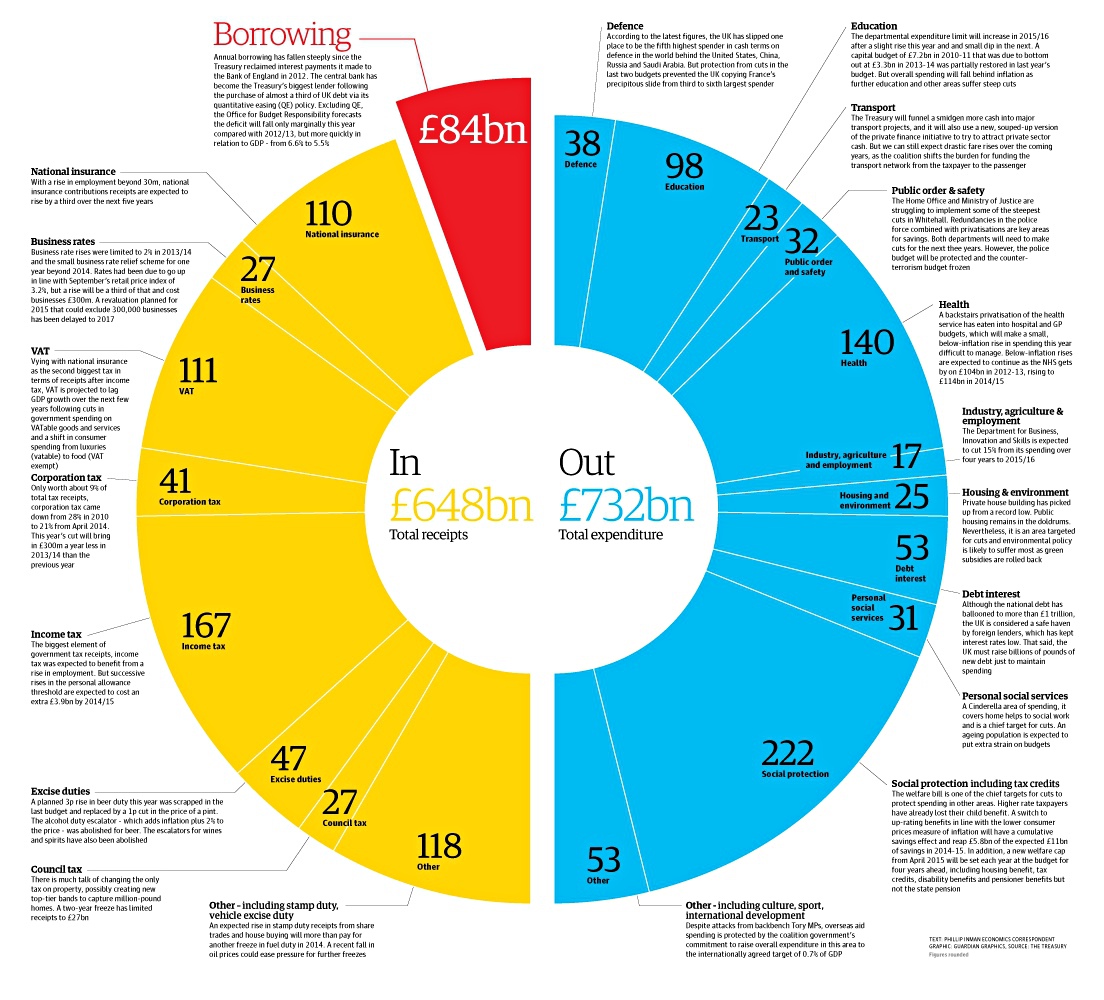

How have the Budget Deficit (or Surplus) and the Borrowing Requirement Changed in Recent Years?

Before the 1930s UK government believed that there should be a balanced budget as it was their moral duty. This is known as sound finance or fiscal orthodoxy. It was seen that a budget surplus was the same as steeling from the taxpayers and if they ran a budget deficit it was perceived as they were bankrupt and unable to manage its finances. As both the budget surplus and budget deficit were seen as undesirable the government felt it was their duty for a balanced budget.

In the 1930's economist John Maynard Keynes legitimised deficit financing, but it wasn't until the 1970's that the view of monetarist economists returned the belief to having a balanced budget. Keynes believed that the great depression hat caused by cyclical unemployment as in the economy as a whole there was too little spending as individuals and firms were saving too much. He argued that running a budget deficit could be financed by government by borrowing, then using its public sector programme and then spending the private sector's excess savings. Injecting spending into the economy and gets rid of the cyclical unemployment.

In the 1930's economist John Maynard Keynes legitimised deficit financing, but it wasn't until the 1970's that the view of monetarist economists returned the belief to having a balanced budget. Keynes believed that the great depression hat caused by cyclical unemployment as in the economy as a whole there was too little spending as individuals and firms were saving too much. He argued that running a budget deficit could be financed by government by borrowing, then using its public sector programme and then spending the private sector's excess savings. Injecting spending into the economy and gets rid of the cyclical unemployment.

Distinguish Between a Budget Deficit and a Budget Surplus and Relate the Budget Deficit to the Government's Borrowing Requirment

A budget deficit occurs when government spending exceeds government revenue (G>T), as where a budget surplus occurs when government spending is less than government revenue (G<T).

When there is a persistent budget deficit which cannot be corrected by elimination government must finance the budget deficit. This is done by increasing borrowing of foreign money, resulting in a positive borrowing requirement. Known as deficit financing (deliberately running a budget deficit and borrowing money to finance the deficit). It is used to inject demand into an economy, to reduce demand-deficient unemployment.

When there is a persistent budget deficit which cannot be corrected by elimination government must finance the budget deficit. This is done by increasing borrowing of foreign money, resulting in a positive borrowing requirement. Known as deficit financing (deliberately running a budget deficit and borrowing money to finance the deficit). It is used to inject demand into an economy, to reduce demand-deficient unemployment.

What is the Difference between Eliminating and Financing a Budget Deficit?

A budget deficit occurs when government spending exceeds government revenue (G>T). It can be ELIMINATED by making cuts to government spending or by increasing taxation, in the hope that it will it will create a balance (G=T) or surplus (G<T). Only if the budget deficit continues where government spending exceeds government revenue it has to FINANCED by public sector borrowing, also known as public sector's cash requirement. When there is a budget deficit there is a positive borrowing requirement.

Monday, 9 March 2015

How does Keynesian Fiscal Policy Differ from Supply Side-side Fiscal Policy?

Fiscal policy is the use of government spending, taxation and the government's budgetary position. It is often associated with Keynesian economists, between the years of 1950 and 1970 the UK government used Keynesian fiscal policy to manage the level of aggregate demand to achieve macroeconomic policy objectives. As government spending (G) is one of the components of aggregate demand [AD=C+G+(I-X)], an increasing in government spending or a decrease in government taxation would cause a rightward shift of aggregate demand and an increase in the budget deficit.

Fiscal policy is the use of government spending, taxation and the government's budgetary position. It is often associated with Keynesian economists, between the years of 1950 and 1970 the UK government used Keynesian fiscal policy to manage the level of aggregate demand to achieve macroeconomic policy objectives. As government spending (G) is one of the components of aggregate demand [AD=C+G+(I-X)], an increasing in government spending or a decrease in government taxation would cause a rightward shift of aggregate demand and an increase in the budget deficit.

Fiscal policy is primarily used as a supply-side policy. It is used to increase the economy's ability to produce and supply goods, through creating incentives to work, save, invest and to be entrepreneurial) such as cutting income tax rates, not to stimulate aggregate demand but to create supply-side incentives in the economy. Its aim is to shift the economies long run supply curve to the right, increasing the potential output.

Recent UK governments have believed that using fiscal policy in a demand-side way to stimulate or reflate aggregate demand to achieve growth and full employment is, in the long run, inefficient and damaging. It is said the growth from explanatory fiscal policy only occurs in the short term and that it mainly impacts on inflation. Supply-side economics and fiscal policy have also been used to create stability in the economy, so that economic agents, particularly businesses, are not subject to sudden susurprisesn the form of unexpected tax changes.

Distinguishing Between Fiscal Policy and Monetary Policy

Fiscal policy is the use of government spending, taxation and the government's budgetary position. As where the monetary policy involves the use of interest rates to achieve the government's policy objectives. Both fiscal and monetary policies are used in combination with other policies to achieve the macroeconomic objectives of:

Monetary policy is mainly used to control the flow of money. If the money supply flows are too fast then inflation will rise and if the money supply flows are too slow then inflation will fall. The use of monetary policy aims to keep inflation at the target rate of 2% CPI.

- low unemployment

- sustainable and positive economic growth

- low levels of CPI inflation

- a 'satisfactory' balance on the current account of the balance of payments

- exchange rate stability.

Monetary policy is mainly used to control the flow of money. If the money supply flows are too fast then inflation will rise and if the money supply flows are too slow then inflation will fall. The use of monetary policy aims to keep inflation at the target rate of 2% CPI.

Subscribe to:

Comments (Atom)